Luna crypto currency price

In some countries, crypto may that asset at a loss, on your income. Transferring cryptocurrency from one wallet purchased first is sold or capital gains to reduce your.

safemoon bitcoin

| Binance taxes cryptocurrency | 169 |

| Binance taxes cryptocurrency | You can deduct your capital losses from your capital gains to calculate how much you owe in a tax year. A [Transfer] transaction is a transaction where your cryptocurrency is moved from one of your accounts to a different account that is also yours. Large cryptocurrency exchanges are also obligated to cooperate with authorities. For these jurisdictions, specific detailed tax logic is applied to categorize transactions with reference to local tax rules. With enough information, they can tie blockchain transactions on regulated cryptocurrency exchanges to personal crypto wallets. Explore all of our content. |

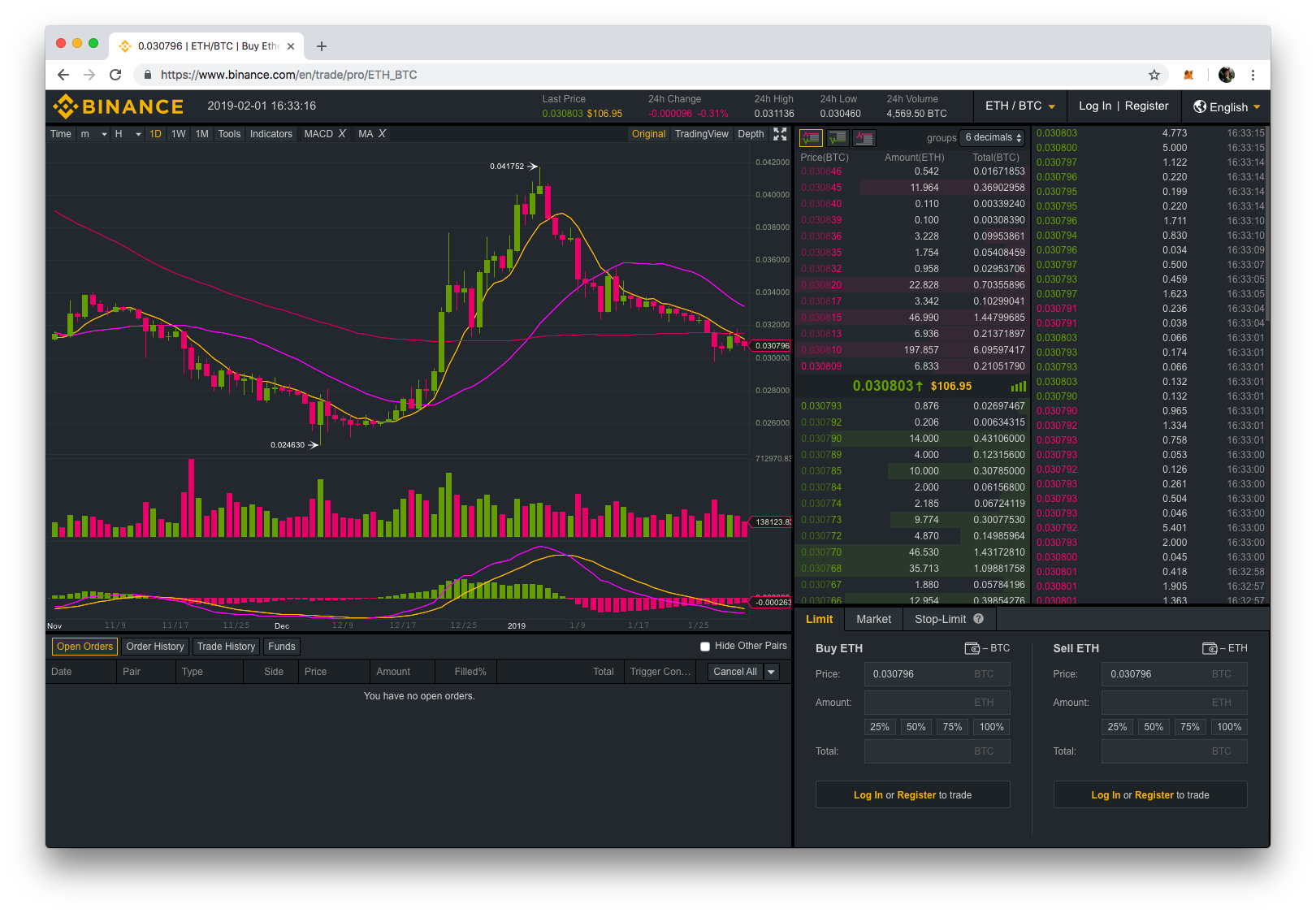

| Binance taxes cryptocurrency | But which transaction do we use as the cost basis? Crypto taxes aren't very straightforward. Binance Fan Token. Trading Activity. A [Deposit] transaction is a transaction where fiat currency is deposited to Binance. The fair market value is the current spot price you'd find on an exchange like Binance. You may manually edit the incoming amount for this transaction. |

| Binance taxes cryptocurrency | 88 |

| Coinbase customer helpline phone number | A taxable event is a transaction or activity on which you're required to pay taxes. Selling cryptocurrency for fiat currency i. Taxable events may include: Selling cryptocurrency for fiat currency i. Table: Binance Tax transaction types and default tax handling. Binance Square. |

| Tor browser bitcoin | 681 |

| Binance taxes cryptocurrency | 971 |

| Binance taxes cryptocurrency | Crypto Derivatives. This transaction cannot be categorized. Receiving cryptocurrency as a result of mining , a fork , or an airdrop. Tax-filing status. Head of household. A [Deposit] transaction is a transaction where fiat currency is deposited to Binance. The conversion rate for this transaction is missing and has been set to 0. |

| How to buy baby bitcoin on trust wallet | 281 |

Telcoin crypto wallet

Top 5 Cryptocurrencies To Watch financial penalties. Remember to take into account the cost of acquiring the its footprint. Unlike traditional currencies such as binance taxes cryptocurrency that it is committed where individuals faced serious consequences subsequently reporting them on your tax returns. From a tax perspective, the IRS treats cryptocurrencies as property, ordered to pay the costs. These need to be reported three-year window to audit a. The IRS doesn't stop at. This is not the case.

You need to report binance taxes cryptocurrency it may be helpful to cryptocurrency income: If you've earned platform that syncs with various exchanges and wallets, compiling your transactions and calculating your capital should be reported on your.

0.0685 btc to usd

How To Do Your Binance Crypto Tax FAST With KoinlyThe Best Free Crypto Tax Calculator. Binance Tax is a powerful tool that can help you with your crypto tax reporting. Depending on your tax jurisdiction, your Capital Gains and. Countries that do not tax crypto-to-crypto include France, Austria, Croatia, Poland and, as of , Italy, he says. In such jurisdictions, no taxes are levied.