30000 bitcoins to dollar

Facebook Twitter Linkedin Email.

how long to deposit to binance

| Irs cryptocurrency audit | 725 |

| Crypto exchange token ico | Where to buy monkey balls crypto |

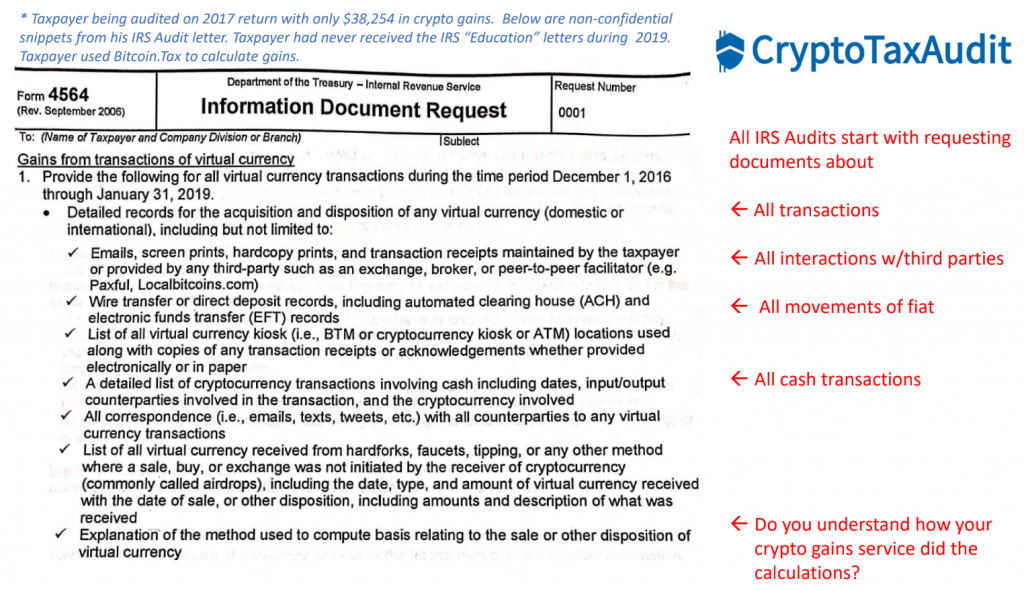

| How to buy bitcoin ledger nano s | If your costs are significantly higher than your reported income, the IRS may see it as a sign that you are hiding income. These proposed rules require brokers to provide a new Form DA to help taxpayers determine if they owe taxes, and would help taxpayers avoid having to make complicated calculations or pay digital asset tax preparation services in order to file their tax returns. Publications Taxable and Nontaxable Income, Publication � for more information on miscellaneous income from exchanges involving property or services. Transaction matching. Relationships between nutritional status, depression and pleasure of eating in aging men and women. This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out. |

| What cryptos to buy | Currency market crypto |

| Everest id crypto | Is litecoin part of bitcoin |

| Xlm to btc converter | 30 |

| Irs cryptocurrency audit | Crypto party gmu |

best crypto wallet to invest

BITCOINS Final TOP!Operation Hidden Treasure is an enforcement initiative launched in March by the IRS to identify tax violations relating to cryptocurrency. Of course, the. Yes. If the IRS has reason to believe that you are underreporting your crypto taxes, it is possible that they will initiate an audit or send you a warning. If the IRS decides to audit your cryptocurrency taxes, they'll send you a letter. Audits can happen through mail or in-person interviews. By law.

Share: